Because shareholder’s equity equals total assets less total liabilities, this may be the same as capital employed under the fixed asset method if a company does not have any long-term liabilities. For example, if there are no long-term liabilities, this means 100% of liabilities are current. This also means the calculation using the total assets method will equal the equity method.

How to Calculate ROCE

This could be broken down by capital used for the business (working capital) and capital used for investment (buying new equipment). If they had $10,000 in working capital and $40,000 that was used to buy land then their capital employed would be $50,000. CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation. CFI is on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path.

Example of How to Use ROCE

- Capital employed is often used in ratios (such as the ROCE formula we talked about above).

- Capital employed represents the total funds invested in a company’s operations, including both equity and debt.

- Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.

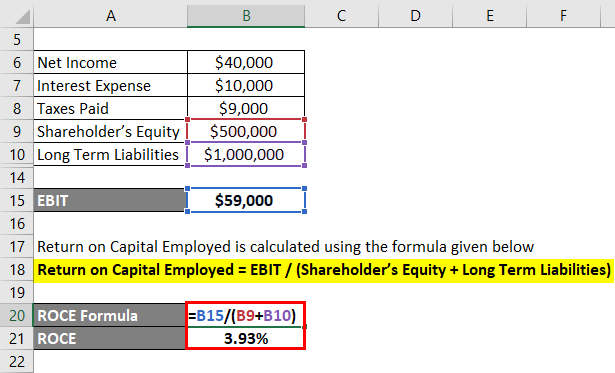

The return on capital employed (ROCE) and return on invested capital (ROIC) are two closely related measures of profitability. That said, the capital employed encompasses shareholders’ equity, as well as non-current liabilities, namely long-term debt. The calculation of return on capital employed is a two-step process, starting with the calculation of net operating profit after taxes (NOPAT). The return on capital employed is a metric that indicates how many operating profits a company makes compared to the capital employed. You can find capital employed by deducting current liabilities from total assets.

Silicon Valley Bank Failure & Its Impact on Business Lending

Sometimes it is equal to all current equity plus interest-generating loans (non-current liabilities). A company finances its capital employed through its capital investments. Pay attention to shareholders’ equity, net debt, and other long-term assets and liabilities when performing an analysis. A higher return on capital employed suggests a more efficient company, at least in terms of capital employment. A higher number may also be indicative of a company with a lot of cash on hand since cash is included in total assets.

Capital employed is often used in ratios (such as the ROCE formula we talked about above). As mentioned in the last paragraph, equity is factored into formulas like return on equity (ROE) that track what value is generated for shareholders. Ultimately, each is used in different ways to collectively provide a holistic view of a company’s financial performance (focusing on both operational efficiency and shareholder value). A higher ROCE indicates more effective use of capital, while a lower ROCE can be a sign of poor company management or simply a bad business. When evaluating a company, consider other profitability ratios, such as return on equity and return on assets alongside ROCE to get a fuller picture of the company’s financial efficiency. Return on capital employed (ROCE) is a popular financial metric that helps investors, analysts and managers assess the overall profitability of a business.

business.

He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. As always in stock picking, a good ROCE must be used along with the interest coverage ratio and revenue growth analysis. In that case, we have the Synnex first quarter 2020 report, which will be the last of the four quarters taxhow » schedule m we are going to include for calculating the EBIT. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. Profit before interest and tax is also known as earnings before interest and tax or EBIT. Our writers and editors used an in-house natural language generation platform to assist with portions of this article, allowing them to focus on adding information that is uniquely helpful. The article was reviewed, fact-checked and edited by our editorial staff prior to publication. Companies should tailor their strategies based on their specific industry, competitive landscape, and internal capabilities to achieve sustainable improvements in ROCE. As companies enact strategies to improve ROCE, they must be aware of unrelated repercussions that may have negative impacts elsewhere.

But keep in mind that you shouldn’t compare the ROCE ratios of companies in different industries. As with any financial metric, it’s best to do an apples-to-apples comparison. One company that takes a big portion of its capital and applies it towards capital fixed assets may have a high capital ratio (good ROCE). A different company that doesn’t put much capital into capital employed may have a capital ratio that is lower (bad ROCE). The capital ratio can be used to compare the performance of companies in similar industries.

This ratio shows how efficiently a company is using its capital to generate profits, allowing one to compare companies. Return on capital employed (ROCE) is a financial ratio that can be used to assess a company’s profitability and capital efficiency. In other words, this ratio can help to understand how well a company is generating profits from its capital as it is put to use. ROCE is one of several profitability ratios financial managers, stakeholders, and potential investors may use when analyzing a company for investment. To determine the capital employed, current liabilities are subtracted from the total of fixed assets, investments, and current assets. You can calculate capital employed by adding current assets then subtracting the current liabilities.

Last, companies can also back into capital employed if they do have long-term liabilities and know total shareholders’ equity. Because the fixed asset method subtracts current liabilities, a company really only needs to add back the long-term liabilities to total equity to arrive at capital employed. Current liabilities are a company’s short-term financial obligations, usually due within a year or less. You’ll find current liabilities reported on the company’s balance sheet. Examples include accounts payables, accrued expenses, short-term debt, and dividends payable.